wichita ks sales tax rate 2019

31 rows The state sales tax rate in Kansas is 6500. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax.

There is no applicable city tax or special tax.

. For married taxpayers living and working in the state of Kansas. 679 rows Kansas Sales Tax. The Kansas use tax rate is 65 the same as the regular Kansas sales tax.

For tax rates in other cities see Kansas sales taxes by city and county. For 2017 the city is budgeting for. There may be additional sales tax based on the city of purchase or residence.

3 Local Sales Tax Distribution of Revenue. Real Estate Taxes Amount. The Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984.

If the square foot basis is used each property owner will be responsible for a share of the project cost relative to the square footage of hisher lot. City of Wichita Falls Taxing Unit Name Phone area code and number Taxing Units Address City State ZIP Code Taxing Units Website Address. Iowa also 1 percent.

Effective Tax Rates for Retail Sales Associates in Wichita KS 89 full-time salaries from 2019 25 4 salaries 0 salaries 11 salaries 64 salaries 7 salaries 3 salaries Track your money in Mint Save more of what you earn when you budget in Mint. Tax rate of 57 on taxable income over 30000. In 2015 Wichita collected 443 million in franchise taxes.

- Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home. The 65 state plus a 145. Check out this handy publication for instructions on registering your business in Kansas.

With local taxes the total. In 2019 it was 32721 based on the Sedgwick County Clerk. The Kansas use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Kansas from a state with a lower sales tax rate.

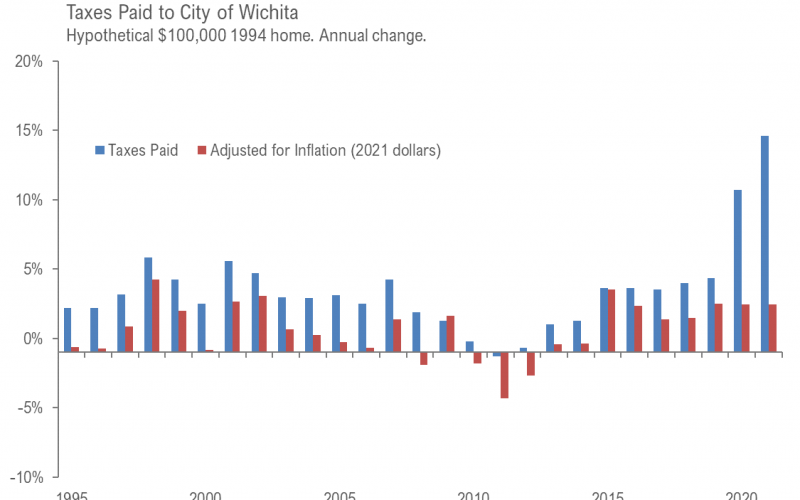

Kansas asks that you file for your sales tax license 3-4 weeks before you plan to start actually making sales in the state. Therefore larger lots will pay more than smaller lots. Thats an increase of 1431 mills or 457 percent since 1994.

You can print a 75 sales tax table here. By comparison the citys share of the county-wide one cent per dollar sales tax was 580 million. The total sales tax rate is 75.

If you need access to a database of all Kansas local sales tax rates visit the sales tax data page. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median. A 500 fee will be applied to each transaction handled at any of the Tag Offices.

The County sales tax rate is. Wichita City Council is raising the sales tax from 75 to 95 - a 27 increase - in a community improvement district near the new baseball stadium and on the east bank of the Arkansas River. The minimum combined 2022 sales tax rate for Wichita Kansas is.

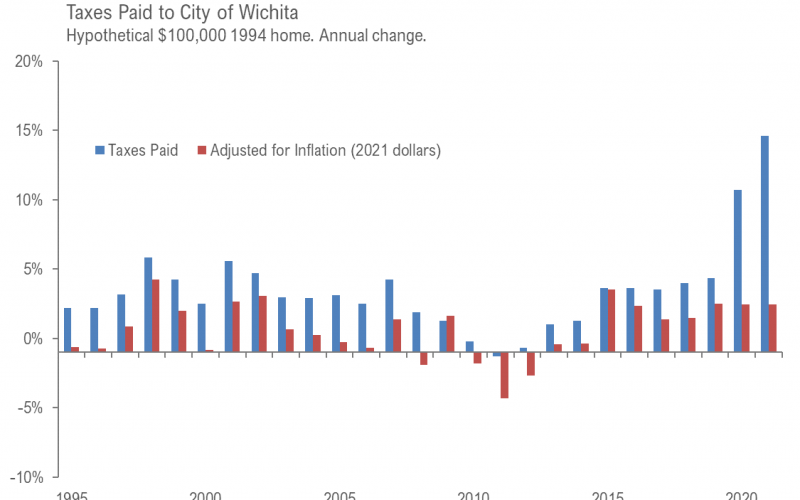

These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates. The most common methods of assessment are the square foot basis and the fractional basis. Tax rate of 31 on the first 30000 of taxable income.

In 2014 the city estimated that a one cent per dollar city sales tax would generate 80 million per year. 5 rows Kansas sales tax changes effective July 1 2019. Including local taxes the Kansas use tax can be as high as 3500.

Sales Tax On Food. And local sales tax rate for Finney County outside the city limits of Garden City is 795. Collect Retailers Sales Tax.

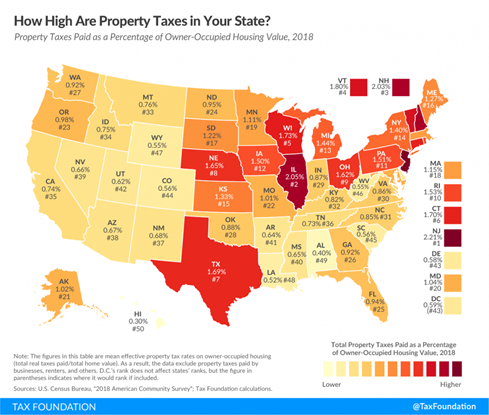

Kansas has 677 cities counties and special districts that collect a local sales tax in addition to the Kansas state sales taxClick any locality for a full breakdown of local property taxes or visit our Kansas sales tax calculator to lookup local rates by zip code. Sales tax collected and spent on MO expenses in 2018. On March 26 2019 the Kansas Senate confirmed Mark Burghart as the Secretary of Revenue.

Franchise fees collected by the City of Wichita for 2015. The Wichita sales tax rate is. The Kansas sales tax rate is currently.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. Enter amount from full year. This is the total of state county and city sales tax rates.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. Tax rate of 525 on taxable income between 15001 and 30000. Tax rate of 57 on taxable income over 60000.

Tax rate of 525 on taxable income between 30001 and 60000. If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636. In Wichita the local sales tax rate is 1 for Sedgwick County.

Average Sales Tax With Local. The gross receipts tax is much like a Value Added Tax only for businesses rather than individuals. Divide Line 15 by Line 23 and multiply by 10018 0706083100 25.

Des Moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent. 1-22 2 KANSAS SALES TAX. Motor Vehicle Taxes.

If the fractional basis is used each lot in. The rate in Sedgwick County is 75 percent. 3 lower than the maximum sales tax in KS.

New sales and use tax rates take effect. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE.

2019 effective tax rate. Compare sales tax rates by city and see which cities have the highest sales taxes across the United States.

Wichita Property Tax Rate Up Just A Little

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Kansas Income Tax Calculator Smartasset

Sales Tax Rates In Major Cities Tax Data Tax Foundation

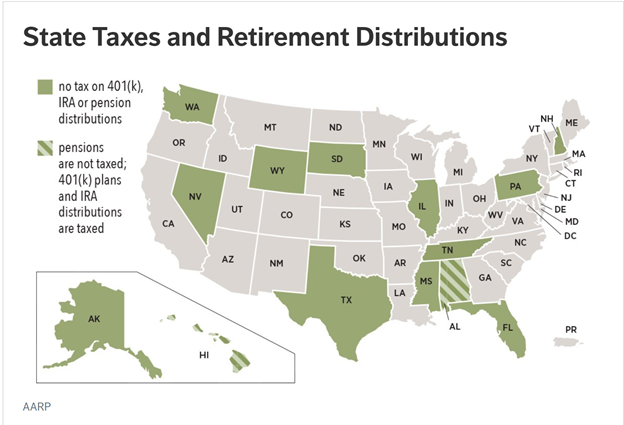

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Sedgwick County Democratic Party Facebook

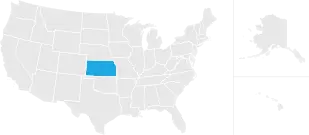

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Wichita Property Tax Rate Up Just A Little

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Wichita Property Tax Rate Up Just A Little

Wichita Property Tax Rate Up Just A Little

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax On Cars And Vehicles In Kansas

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute